Introduction:

The Silent Money Leak in Car Ownership

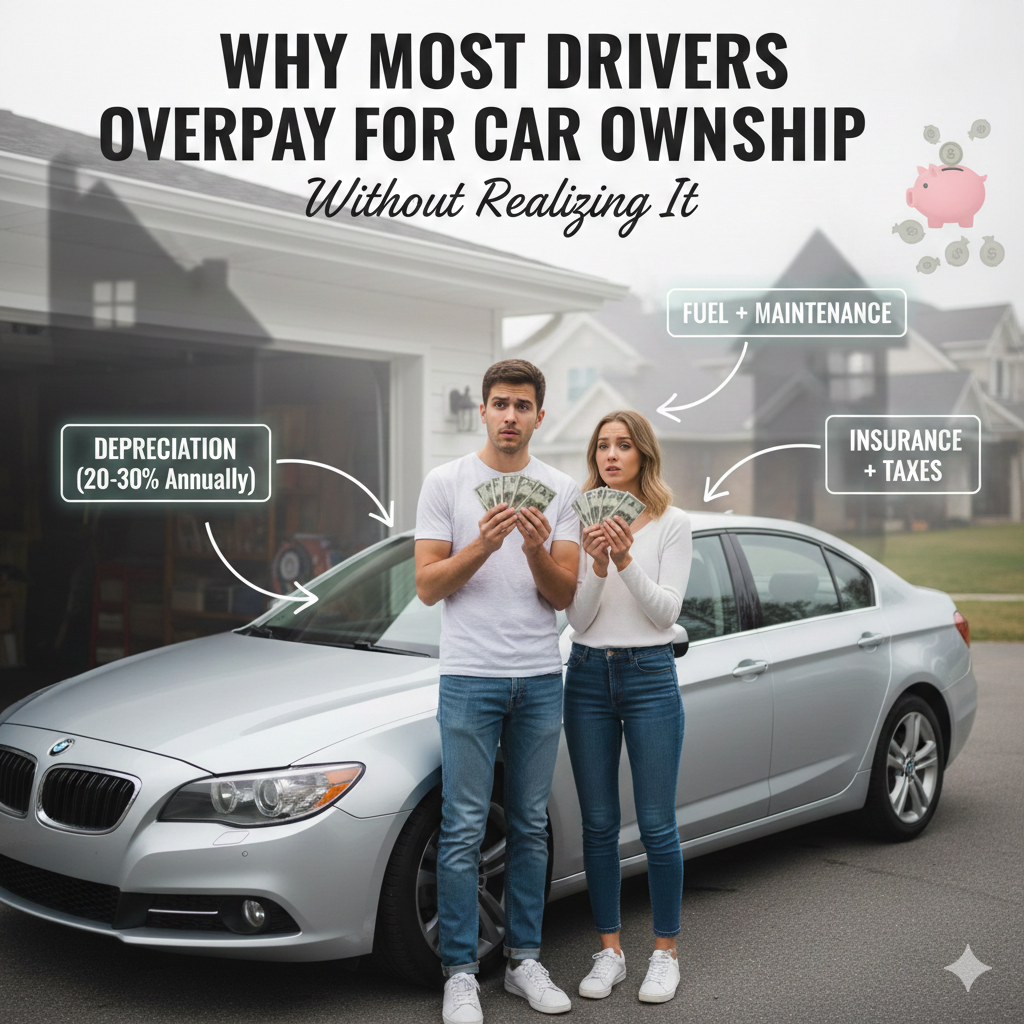

For most drivers, expensive car ownership feels normal. High fuel costs, regular repairs, rising insurance premiums—it all seems like “just part of owning a car.” But the truth is, many people overpay for car ownership without ever realizing where their money is actually going.

The problem isn’t one big mistake. It’s dozens of small decisions: choosing a low monthly payment without checking long-term costs, delaying maintenance, overpaying for insurance, or ignoring how driving habits affect wear and tear. Each choice seems minor on its own—but together, they quietly drain thousands over the life of a vehicle.

This guide breaks down why car ownership costs spiral, where drivers lose the most money, and—most importantly—how to stop it. With better awareness and a few smarter habits, you can save money on car ownership without sacrificing safety or reliability.

1. Focusing Only on Monthly Payments Instead of Total Costs

One of the biggest reasons drivers overpay for car ownership is focusing only on the monthly payment. A low payment feels affordable—but it hides the true cost of owning a car.

Monthly payments don’t include:

- Maintenance and repairs

- Insurance premiums

- Fuel and operating costs

- Depreciation (loss of value)

A car with a “cheap” payment can end up costing far more over time due to higher insurance, poor reliability, or rapid depreciation. Long loan terms make this even worse, as interest adds thousands to the total price.

Smarter approach:

- Calculate total ownership cost per year, not just monthly payments

- Factor in insurance, maintenance, fuel, and depreciation

- Compare cars based on long-term value, not short-term affordability

Understanding car ownership costs upfront prevents years of unnecessary overpayment.

2. Ignoring Preventive Maintenance Until It’s Too Late

Skipping maintenance is one of the most expensive car maintenance mistakes drivers make. Missing oil changes, fluid services, or inspections feels harmless—until it isn’t.

Small maintenance delays often lead to:

- Engine damage from dirty oil

- Transmission issues from neglected fluids

- Brake failures from worn components

Preventive maintenance costs a little now, but emergency repairs cost many times more later. A skipped oil change can turn into a multi-thousand-dollar engine repair.

Why preventive care saves money:

- Problems are caught early, when fixes are cheaper

- Parts last longer with proper servicing

- Breakdowns and towing costs are avoided

If you want to avoid costly repairs, preventive maintenance isn’t optional—it’s one of the most powerful ways to stop overpaying.

3. Paying Too Much for Insurance Coverage

Insurance is essential, but many drivers overpay because they never review their policies. Over-insuring or buying unnecessary add-ons quietly inflates annual costs.

Common insurance mistakes include:

- Paying for coverage that no longer fits the car’s value

- Keeping the same policy for years without shopping rates

- Missing discounts for safe driving, bundling, or low mileage

How to lower insurance costs safely:

- Review coverage at least once a year

- Adjust deductibles to match your financial situation

- Remove add-ons you don’t need

Reducing car insurance costs doesn’t mean risking protection—it means paying only for what actually makes sense.

4. Choosing Cheap Repairs That Fail Faster

When something breaks, many drivers choose the cheapest fix available. Unfortunately, cheap repairs often fail faster, turning into repeat expenses.

Low-quality parts and rushed labor can lead to:

- Replacing the same part multiple times

- Additional damage to surrounding components

- Higher long-term repair costs

Better strategy:

- Choose quality parts that last longer

- Use trusted mechanics, not just the lowest quote

- Focus on value, not just price

Spending slightly more on reliable repairs often saves hundreds or thousands over time.

5. Poor Driving Habits That Increase Wear and Tear

How you drive directly affects how much you pay for car ownership. Aggressive habits quietly shorten the life of major components.

Costly driving behaviors include:

- Hard acceleration and sudden braking

- High speeds over rough roads

- Frequent short trips that never warm the engine

These habits increase wear on brakes, tires, suspension, and engines—leading to higher repair bills.

Money-saving habits:

- Smooth acceleration and gradual braking

- Avoid unnecessary short trips

- Let the engine warm up naturally

Smart driving habits are one of the easiest ways to save money on car ownership without any extra spending.

6. Neglecting Tires and Alignment

Tires are often ignored until they fail—but poor tire care leads to higher fuel costs and suspension damage.

Common tire mistakes:

- Driving with incorrect tire pressure

- Skipping rotations and alignments

- Replacing tires too late

Misaligned wheels wear tires unevenly and strain suspension parts, creating expensive repairs down the line.

Simple fixes that save money:

- Check tire pressure monthly

- Rotate tires regularly

- Get alignment checks annually or after pothole damage

Proper tire maintenance improves safety and reduces long-term expenses.

7. Forgetting About Depreciation and Resale Value

Depreciation is one of the largest hidden car expenses. Cars lose value every year, but many drivers don’t think about resale until it’s too late.

Poor maintenance, cosmetic damage, and missing service records can dramatically reduce resale value.

How to slow depreciation:

- Maintain both mechanical and visual condition

- Protect paint and interior from damage

- Keep detailed maintenance records

Planning for resale early prevents thousands in lost value later.

8. Paying for Features and Add-Ons You Don’t Need

Dealer add-ons and accessories often inflate ownership costs without delivering real value.

Common unnecessary expenses include:

- Overpriced extended warranties

- Cosmetic upgrades with no resale benefit

- Tech features rarely used

Smart approach:

- Research which add-ons actually provide value

- Skip emotional purchases during buying decisions

- Add essentials later at lower cost if needed

Avoiding unnecessary extras reduces hidden car expenses immediately.

9. Not Tracking Car Expenses at All

Many drivers have no idea how much they truly spend on their cars each year. Without tracking, overspending goes unnoticed.

Untracked costs include:

- Small repairs

- Fuel fluctuations

- Parking, tolls, and fees

Simple tracking methods:

- Use a notes app or spreadsheet

- Track monthly and annual totals

- Review expenses quarterly

Awareness alone often leads to better decisions and lower spending.

FAQs: Why Car Ownership Costs More Than Expected

Why is car ownership so expensive?

Because costs go far beyond payments—maintenance, insurance, fuel, depreciation, and repairs add up quickly.

How can I stop overpaying for my car?

Track expenses, maintain the car proactively, review insurance yearly, and drive more gently.

What are the biggest hidden car expenses?

Depreciation, insurance add-ons, delayed maintenance, tire neglect, and poor resale planning.

How much should car ownership cost per year?

It varies, but budgeting 10–15% of the car’s value annually for all costs is a realistic starting point.

Conclusion: Awareness Is the First Step to Saving Thousands

Most drivers don’t overpay because they’re careless—they overpay because no one shows them where the money leaks happen. Small decisions, repeated over time, quietly inflate car ownership costs.

By understanding these mistakes and making smarter choices, you can stop wasting money, protect your vehicle, and take control of your finances.

Car ownership doesn’t have to be a financial drain. With awareness, planning, and preventive habits, you can save thousands without giving up safety or reliability.